Table Of Content

In addition to mortgages options (loan types), consider some of these program differences and mortgage terminology. When a loan exceeds a certain amount (the conforming loan limit), it's not insured by the Federal government. Loan limits change annually and are specific to the local market.

How much is private mortgage insurance?

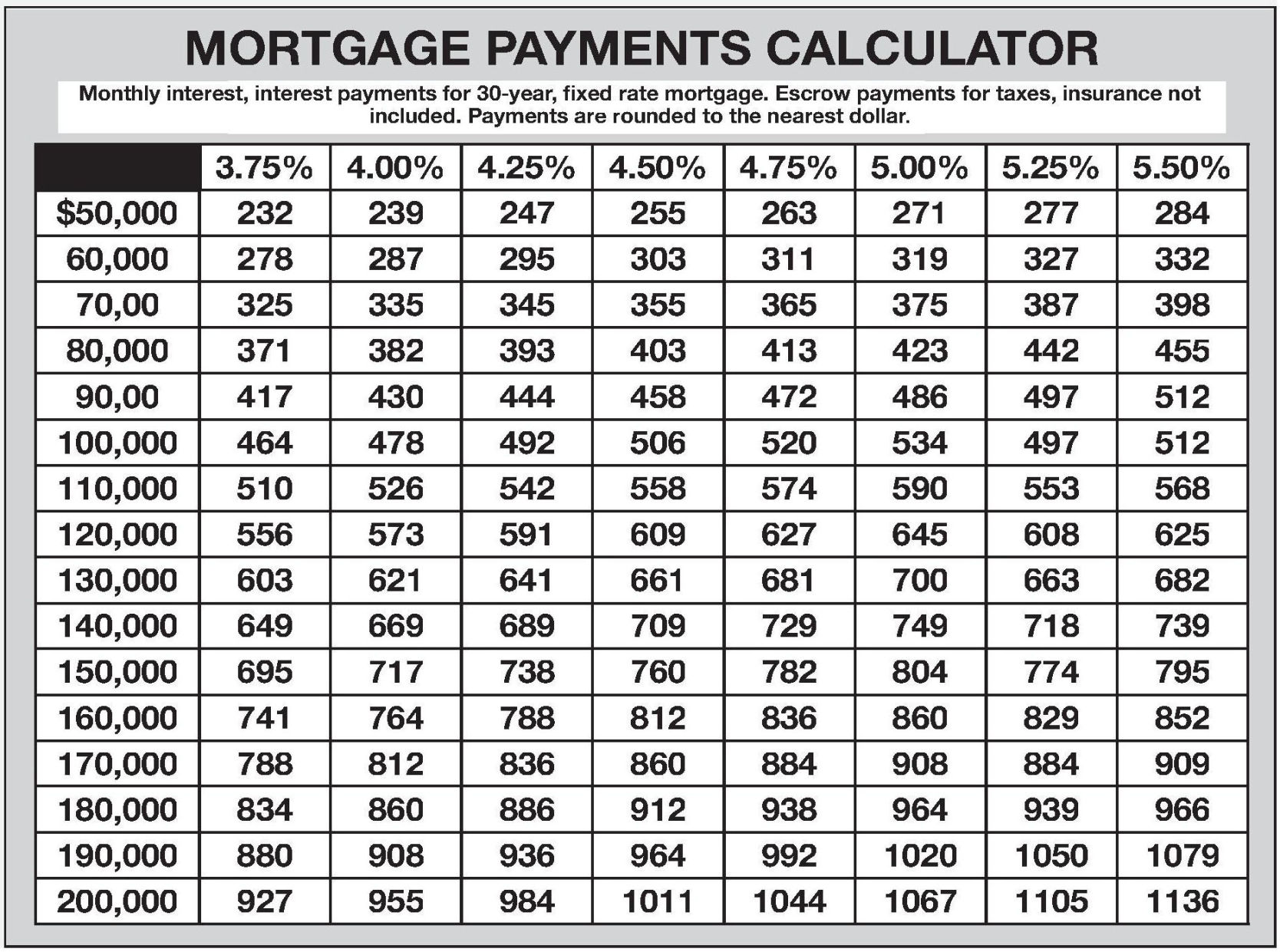

Then take your annual income and divide by 12 to determine your monthly income. Fixed-rate loans have the same interest rate for the entire duration of the loan. That means your monthly home payment will be the same, even for long-term loans, such as 30-year fixed-rate mortgages.

Home affordability FAQs

Is your credit score in great shape, and is your overall debt load manageable? Do you have enough savings that a down payment won’t drain your bank account to zero? If your personal finances are in excellent condition, a lender will likely be able to give you the best deal possible on your interest rate.

How to calculate mortgage payments

We believe everyone should be able to make financial decisions with confidence.

Type of home loans to consider

By inputting a home price, the down payment you expect to make and an assumed mortgage rate, you can see how much monthly or annual income you would need — and even how much a lender might qualify you to borrow. USDA loans require no down payment, and there is no limit on the purchase price. However, these loans are geared toward buyers who fit the low- or moderate-income classification, and the home you buy must be within a USDA-approved rural area.

USDA loan (government loan)

Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout life’s financial journey. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information.

How Much House Can I Afford On A $130K Salary? - Bankrate.com

How Much House Can I Afford On A $130K Salary?.

Posted: Wed, 04 Oct 2023 07:00:00 GMT [source]

Interest rate

If you want to explore an FHA loan further, use our FHA mortgage calculator for more details. Bankrate follows a stricteditorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

How to lower your monthly mortgage payment

If Joe were to abide by the 28/36 rule, he’d spend no more than $1,400 on a mortgage payment each month. Bankrate's calculator also estimates property taxes, homeowners insurance and homeowners association fees. You can edit these amounts, or even edit them to zero, as you're shopping for a loan. An FHA loan is government-backed, insured by the Federal Housing Administration. FHA loans have looser requirements around credit scores and allow for low down payments. An FHA loan will come with mandatory mortgage insurance for the life of the loan.

Likely rate: 7.422% Edit rate

The amount of the property tax varies depending on where you live, and is usually calculated as a percentage of your property’s value. When you buy a home, you may have to pay a prorated amount of the property tax that depends on when you complete the home purchase. A house is one of the biggest purchases you can make, so figuring out how much you can afford is a key step in the home-buying process. The amount of cash a borrower pays upfront to buy a home; it goes toward the purchase price with mortgage loans typically used to finance the remaining amount.

In 2019, the average annual cost of homeowners insurance was $1,083 nationwide. The cost of homeowners insurance policy will vary depending on the type of property being insured (e.g. condominium, mobile home, single-family residence, etc.) and the amount of coverage the owner desires. Lenders require that buyers obtain homeowners insurance in order for the insurance premium to be included in the monthly mortgage payment. As a homeowner, you’ll pay property tax either twice a year or as part of your monthly home payment. This tax is a percentage of a home’s assessed value and varies by area. For example, a $500,000 home in San Francisco, taxed at a rate of 1.159%, translates to a payment of $5,795 annually.It’s important to consider taxes when deciding how much house you can afford.

Remember, your monthly house payment includes more than just repaying the amount you borrowed to purchase the home. The "principal" is the amount you borrowed and have to pay back (the loan itself), and the interest is the amount the lender charges for lending you the money. Use this tool to calculate the maximum monthly mortgage payment you'd qualify for and how much home you could afford. This loan is a great option for anyone who is a veteran or currently serving in the United States military.

Typically, they start out at a lower interest rate than a fixed-rate loan and hold that rate for a set number of years before changing interest rates from year to year. For example, if you have a 5/1 ARM, you will have the same interest rate for the first 5 years, and then your mortgage interest rate will change from year to year. The main benefit of an adjustable-rate loan is starting off with a lower interest rate to improve affordability. To calculate how much house you can afford, we’ve made the assumption that with at least a 20% down payment, you might be best served with a conventional loan. However, if you are considering a smaller down payment, down to a minimum of 3.5%, you might apply for an FHA loan.

Your estimated annual property tax is based on the home purchase price. The total is divided by 12 months and applied to each monthly mortgage payment. If you know the specific amount of taxes, add as an annual total. Federal Housing Agency mortgages are available to homebuyers with credit scores of 500 or more and can help you get into a home with less money down. If your credit score is below 580, you'll need to put down 10 percent of the purchase price.

No comments:

Post a Comment