Table Of Content

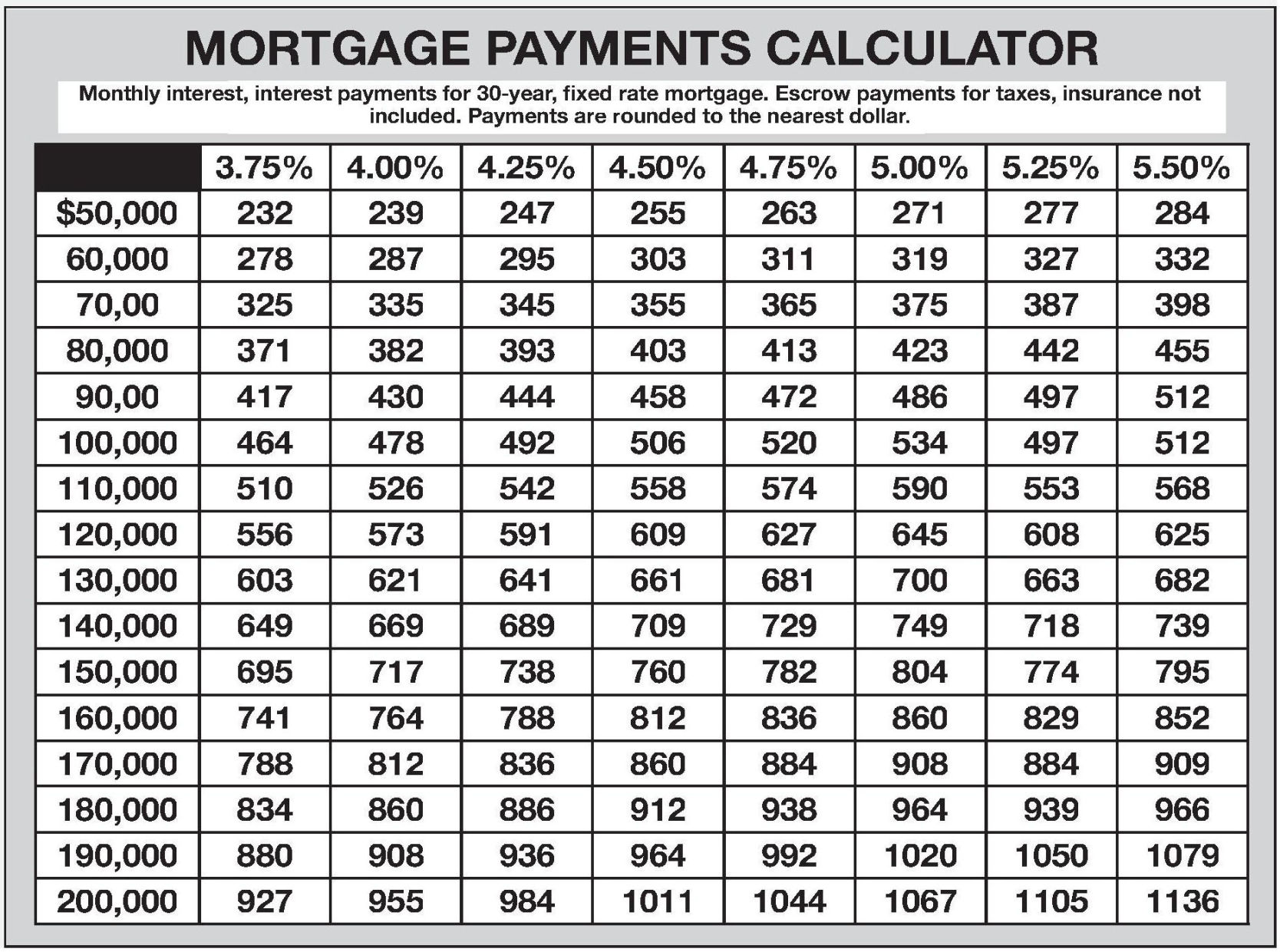

Loan amount - If you're getting a mortgage to buy a new home, you can find this number by subtracting your down payment from the home's price. If you're refinancing, this number will be the outstanding balance on your mortgage. In order to receive a helpful estimate, it’s important that you input accurate information. Debt payments are payments you make to pay back the money you borrowed. We’re transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

How much are closing costs?

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. Most people use a mortgage calculator to estimate the payment on a new mortgage, but it can be used for other purposes, too. Conforming loans have maximum loan amounts that are set by the government and conform to other rules set by Fannie Mae or Freddie Mac, the companies that provide backing for conforming loans. A non-conforming loan is less standardized with eligibility and pricing varying widely by lender. Non-conforming loans are not limited to the size limit of conforming loans, like a jumbo loan, or the guidelines like government-backed loans, although lenders will have their own criteria.

You’re our first priority.Every time.

A 5-year ARM, for instance, offers a fixed interest rate for 5 years and then adjusts each year for the remaining length of the loan. Typically the first fixed period offers a low rate, making it beneficial if you plan to refinance or move before the first rate adjustment. The United States Department of Agriculture backs USDA loans that benefit low-income borrowers purchasing in eligible, rural areas.

Home affordability begins with your mortgage rate

However, this loan typically requires private mortgage insurance (PMI) which should be added into your monthly expenditures. PMI is usually .05-1% of the cost of the home loan but may vary depending on credit score. The annual percentage rate (APR) is a number designed to help you evaluate the total cost of a loan. In addition to the interest rate, it takes into account the fees, rebates, and other costs you may encounter over the life of the loan. The APR is calculated according to federal requirements, and is required by law to be included in all mortgage loan estimates. This allows you to better compare different types of mortgages from different lenders, to see which is the right one for you.

How does the amount of my down payment impact how much house I can afford?

How Much Does It Cost to Live in NYC? - Curbed

How Much Does It Cost to Live in NYC?.

Posted: Mon, 22 May 2023 07:00:00 GMT [source]

Then take your annual income and divide by 12 to determine your monthly income. Fixed-rate loans have the same interest rate for the entire duration of the loan. That means your monthly home payment will be the same, even for long-term loans, such as 30-year fixed-rate mortgages.

For most borrowers, the total monthly payment sent to your mortgage lender includes other costs, such as homeowner's insurance and taxes. If you have an escrow account, you pay a set amount toward these additional expenses as part of your monthly mortgage payment, which also includes your principal and interest. Your mortgage lender typically holds the money in the escrow account until those insurance and tax bills are due, and then pays them on your behalf. If your loan requires other types of insurance like private mortgage insurance (PMI) or homeowner's association dues (HOA), these premiums may also be included in your total mortgage payment. The down payment is an essential component of home affordability. The more you put down upfront, the less you need to borrow — so by making a larger down payment, you reduce your loan-to-value ratio, which makes a difference in how your lender looks at you in terms of risk.

Is your credit score in great shape, and is your overall debt load manageable? Do you have enough savings that a down payment won’t drain your bank account to zero? If your personal finances are in excellent condition, a lender will likely be able to give you the best deal possible on your interest rate.

Bankrate’s mortgage calculator can help you explore how different purchase prices, interest rates and minimum down payment amounts impact your monthly payments. And don’t forget to think about the potential for mortgage insurance premiums to impact your budget. If you make a down payment of less than 20 percent on a conventional loan, you’ll need to pay for private mortgage insurance, or PMI.

If Joe were to abide by the 28/36 rule, he’d spend no more than $1,400 on a mortgage payment each month. Bankrate's calculator also estimates property taxes, homeowners insurance and homeowners association fees. You can edit these amounts, or even edit them to zero, as you're shopping for a loan. An FHA loan is government-backed, insured by the Federal Housing Administration. FHA loans have looser requirements around credit scores and allow for low down payments. An FHA loan will come with mandatory mortgage insurance for the life of the loan.

A mortgage loan term is the maximum length of time you have to repay the loan. Longer terms usually have higher rates but lower monthly payments. It is possible to pay down your loan faster than the set term by making additional monthly payments toward your principal loan balance.

When you buy a home, you will typically have to pay some property tax back to the seller, as part of closing costs. Because property tax is calculated on the home’s assessed value, the amount typically can change drastically once a home is sold, depending on how much the value of the home has increased or decreased. As a home buyer, you’ll want to have a certain level of comfort in understanding your monthly mortgage payments. Private Mortgage Insurance (PMI) is calculated based on your credit score and amount of down payment. If your loan amount is greater than 80% of the home purchase price, lenders require insurance on their investment.

If lenders determine you are mortgage-worthy, they will then price your loan. Your credit score largely determines the mortgage rate you’ll get. The home affordability calculator provides you with an appropriate price range based on your input. Most importantly, it takes into account all of your monthly obligations to determine if a home could be comfortably within financial reach. Let’s say you earn $100,000 each year, which is $8,333 per month.